Our Opening Offshore Bank Account Statements

Table of Contents3 Simple Techniques For Opening Offshore Bank AccountOur Opening Offshore Bank Account IdeasThe Best Strategy To Use For Opening Offshore Bank AccountThe 10-Second Trick For Opening Offshore Bank AccountThe 4-Minute Rule for Opening Offshore Bank AccountUnknown Facts About Opening Offshore Bank AccountFacts About Opening Offshore Bank Account RevealedWhat Does Opening Offshore Bank Account Mean?

Offshore savings accounts can be useful for those who function overseas or that travel regularly. This guide runs via all you require to understand. An overseas interest-bearing accounts is an interest-bearing account kept in a various nation to the one in which you live - in this instance, one outside the UK.Offshore interest-bearing accounts can be used to hold different money, making them helpful if you consistently move cash abroad or if you make money in a money aside from sterling.Yes, yet only a tiny number are readily available for UK locals to open up. To open up most offshore cost savings accounts you need to reside in the country you are trying to open an account in; as an example, be a citizen of the Island of Man. This will certainly depend upon your circumstance.

Some Of Opening Offshore Bank Account

Otherwise, it is not likely to be worth it - unless you can locate an offshore savings account that uses a much higher rates of interest contrasted to UK-based accounts. You have a much bigger choice of savings accounts readily available for you to open up in the UK.You can contrast UK-based cost savings accounts right here.

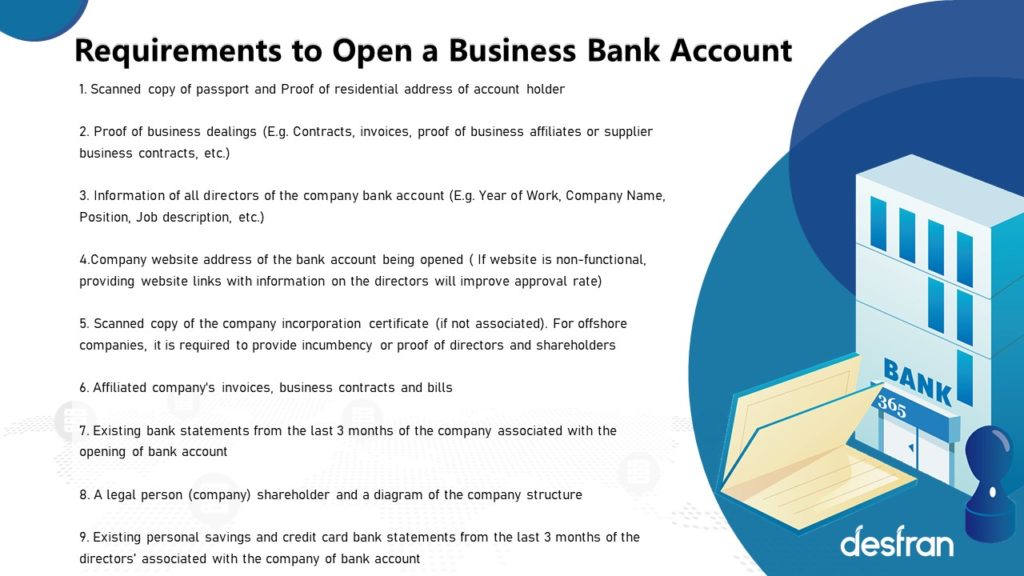

You will not require to take a trip to the country you're opening the account in and rather, you can generally open up the account online, over the phone and even by article. When you open your offshore account, you will need to provide evidence of ID and proof of address. Some banks might also ask you to describe: Where your money has actually originated from; e.

The 5-Minute Rule for Opening Offshore Bank Account

Anything over this needs to be proclaimed to HMRC as well as you need to pay any kind of earnings tax due. Depending on when you open an account and when the tax year ends, you might benefit from a hold-up in between gaining rate of interest and having to pay tax on it.

An overseas interest-bearing accounts is, basically, an interest-bearing account that is based beyond the UK.While it could recollect photos of globetrotting millionaires who transfer money with overseas institutions in order to prevent tax obligation, that's not usually the situation. They're more likely to be opened by deportees and also various other people functioning abroad.

Not known Facts About Opening Offshore Bank Account

You are generally required to invest a minimum of 10,000 to open up an overseas interest-bearing account, so these accounts are not likely to be appropriate for novice savers. This overview discusses exactly how offshore interest-bearing account job, This e-newsletter provides complimentary money-related material, along with various other information concerning services and products. Unsubscribe whenever you want (opening offshore bank account).

Here are some of the leading prices on offer: Enjoy out. Costs for running an overseas savings account can eat right into your returns, for instance, costs for making a withdrawal can be as high as 25 each time. Make sure you fully check an accounts' terms prior to you go on and open it.

Some Known Factual Statements About Opening Offshore Bank Account

You can generally make withdrawals on the internet by transferring your cash in site link the abroad account back right into your UK account. After that, when you intend to top-up your savings, you can move cash money from your UK account right into your overseas go to this website savings account. Yes, you are liable for tax, as well as rate of interest is paid to you without tax obligation deducted, just like UK-based accounts.

Indicators on Opening Offshore Bank Account You Need To Know

For example, if interest is paid annually at the end of April, you could hold the previous year's rate of interest in your account for approximately 20 months. This 'deferral' of the revenue tax repayment due on your overseas savings could allow you to gain a small quantity of extra interest.

6 Simple Techniques For Opening Offshore Bank Account

Cash kept in offshore banks is NOT covered by the UK's so your cash money will certainly not have the exact same criterion of protection it would certainly obtain if you saved with a financial institution or building culture based in the UK.The area of the banks you pick might not be promptly evident from its internet site - yet it will certainly affect whether your cash is shielded if it folded.

In addition, you should investigate the requirement of financial regulation in the country you're considering: are there controls on that can set up a bank and also how it is run? You might want to assume twice around saving cash in a location where there is little policy in place.

Not known Incorrect Statements About Opening Offshore Bank Account

Ought to anything fail with your account, it's essential that you have the ability to look for remedy in a straightforward fashion - and find in a means that will not cost you any kind of extra money. Below, we answer several of the most typical concerns that appear concerning overseas cost savings accounts. Yes, you do.